Manufacturing Update - 8 April, 2025

Insights from articles and reports of interest on manufacturing technology, management, policy, and economics in the US and abroad

Content:

TRADE STORIES:

WHAT NATIONS GET HIT: “See the Trump tariffs by country”

TRUMP’S TARIFF NUMBERS CAME FROM A SIMPLE FORMULA NOT FROM WHAT NATIONS CHARGE THE US: “How are Trump’s Tariff Rates Calculated?”

BACK TO SMOOT-HAWLEY: “Average US Tariff Rate”

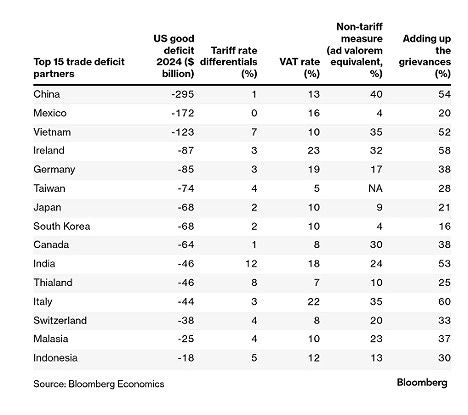

WHERE ARE THE US TRADE ISSUES? “The ‘Dirty Fifteen’ Economies”

WHAT ABOUT US EXPORTS? “Annual 2024 Highlights, U.S. International Trade in Goods and Service”

OPINION: WHY IS HE DOING THIS? “Liberation Day: Explaining Trump’s Tariffs”

OTHER STORIES:

CUTTING THE MEP PROGRAM FOR SMALL MANUFACTURERS: “Trump and DOGE Defund Program that Boosted American Manufacturing for Decades”

IS AN INTEL-TSMC DEAL ON CONTROL OF INTEL’S CHIP FABS IMMINENT? “Intel, TSMC Recently Discussed Chipmaking Joint Venture”

ECONOMIC INEQUALITY IS DRIVING GLOBAL POPULISM – WHERE IS IT NOW IN THE US? “Economic Inequality – The Top 10%”

MORE ON ECONOMIC INEQUALITY: “America Has Never Been Wealthier. Here’s Why it Doesn’t Feel That Way”

Subscribe for free by entering your email address below; you may unsubscribe at any time

TRADE STORIES:

1. WHAT NATIONS GET HIT

“See the Trump tariffs by country,” BBC Journalism team, BBC, April 3, 3025

Looking at the top 12 countries by share of US imports:

All nations face a baseline rate of 10%. No additional tariffs apply to Canada and Mexico. Trump previously set tariffs on goods from those countries at 25%, prior to announcing some exemptions and delays. In addition, the president confirmed the beginning of a new American "25% tariff on all foreign-made automobiles."

Excerpted with edits; more at: https://www.bbc.com/news/articles/c5ypxnnyg7jo

2. TRUMP’S TARIFF NUMBERS CAME FROM A SIMPLE FORMULA NOT FROM WHAT NATIONS CHARGE THE US

“How are Trump’s Tariff Rates Calculated?” Matt Grossman, Anthony DeBarros, and Konrad Putzier, Wall Street Journal, April 3, 2025

It’s a basic formula, and it doesn’t include what countries charge the U.S. The new U.S. tariffs rattling markets and promising globe-spanning trade barriers reflect a fixation of President Trump’s: the difference between how much stuff the U.S. buys and sells to each of its trading partners.

The White House laid out new tariffs on more than 200 countries in two main ways. For more than half, it imposed a flat reciprocal tariff of 10%. For the rest, it added an additional levy based on a basic formula.

In these instances, the Trump administration determined costs it said countries imposed by taking the amount of a nation’s 2024 goods-trade imbalance with the U.S., then dividing that by the value of the goods America imports from that nation.

A White House handout called these costs a tariff charged to the U.S., “Including Current Manipulation and Trade Barriers.” From there, in nearly all cases, the Trump administration imposed new “Discounted Reciprocal Tariffs” of roughly half that result. “Drop your trade barriers…and start buying tens of billions of dollars of American goods,” Trump said Wednesday.

Several economists said that basing tariffs off of bilateral goods deficits is confusing and illogical. Learning of the tariff formula “was like watching a movie, and at the end of it, you’re like, ‘That’s it?’” said David Beckworth, a senior research fellow at George Mason University’s Mercatus Center. Beckworth said a more holistic approach would have taken services trade into account, too—like tech and education the U.S. sells to foreigners. Unlike with goods, America has run an overall services trade surplus for decades, including with most of the nations receiving reciprocal tariffs.

Excerpted with edits; more at (paywall): https://www.wsj.com/economy/trade/trump-tariff-math-calculations-explained-ba47bfde

3. BACK TO SMOOT-HAWLEY

“Average US Tariff Rate,” Paul Krugman, April 2, 2025

This estimate (from Goldman Sachs) assumed an overall 15% tariff rate; when calculated with actual levels with larger trading partners, the average new US tariff rate is significantly higher, around 23%. The bump on the left is the Smoot-Hawley tariff, considered one leading cause of the 30s depression, and the new tariffs would likely be more far-reaching since imports as a share of the economy are three times what they were in the 1920s.

Trump advocates say that tariffs:

1. Won’t increase prices, because foreign producers will absorb the cost,

2. Will cause a large shift in U.S. demand away from imports to domestic production,

3. Will raise huge amounts of revenue.

However, (1) is inconsistent with (2): If prices of imports don’t rise, why would consumers switch to domestically produced goods? At the same time, (2) is inconsistent with (3): If imports drop a lot, tariffs won’t raise a lot of money, because there won’t be much to tax. So the public story about tariffs doesn’t add up.

Excerpted with edits; more at: https://www.reuters.com/technology/intels-new-ceo-plots-overhaul-manufacturing-ai-operations-2025-03-17/

4. WHERE ARE THE US TRADE ISSUES?

“The ‘Dirty Fifteen’ Economies,” Adam Tooze, Chartbook, April 1, 2025

Excerpted with edits; more at (paywall): https://www.bloomberg.com/news/newsletters/2025-03-31/trump-trade-war-asia-seen-in-crosshairs-as-us-readies-tariffs

5. WHAT ABOUT US EXPORTS?

“Annual 2024 Highlights, U.S. International Trade in Goods and Services, December and Annual 2024 report, U.S. Census Bureau and the U.S. Bureau of Economic Analysis, February 5, 2025”

What about the other side of the coin, US exports? The US exports over $3 trillion in goods and services. These range from satellites to aircraft, medical devices, movies and entertainment, agricultural products, telemedicine, and financial services. These exports will decline as their prices rise when nations retaliate for the US tariff increases. The U.S. had record exports to 41 countries in 2024, led by the Mexico ($334.0 billion), the Netherlands ($89.6 billion), and the United Kingdom ($79.9 billion). The chart below shows totals for trade balances in US goods and services:

The US deficit in goods of $1.2T is the highest in history.

A few highlights on exports: US capital goods exports increased $40.2 billion in 2024, including:

Computer accessories increased $11.3 billion in 2024.

Civilian aircraft engines increased $8.7 billion.

Computers increased $8.2 billion.

Semiconductors increased $8.1 billion

US Exports of services increased $81.2 billion to $1,107.8 billion in 2024.

Travel increased $26.3 billion in 2024.

Other business services increased $16.0 billion.

Telecommunications, computer, and information services increased $11.9 billion.

Financial services increased $11.6 billion.

Excerpted with edits; more at: https://www.bea.gov/news/2025/us-international-trade-goods-and-services-december-and-annual-2024

6. OPINION: WHY IS HE DOING THIS?

“Liberation Day: Explaining Trump’s Tariffs,” Rob Atkinson, ITIF, April 4, 2025

Why tariffs? The answer lies in the kinds of businesses Trump favors. Trump’s trade policy favors small businesses and U.S. companies that produce and sell domestically. As such, in the Trumpian trade world, there is deep disdain for “disloyal multinationals”—or, as his former advisor Steve Bannon called them, “the globalists.” They see multinational corporations, especially those that moved operations to China, as having sold out America in pursuit of profits. In 2016, a D.C. conference dominated by mostly Trumpian trade policy types (former U.S. Trade Representative Bob Lighthizer was a speaker). A panel was asked why the U.S. government should not take steps to protect American companies doing business in China from Chinese Communist Party attacks. Their answer: They chose to do business with China, so screw ‘em.

Beyond that, many Trumpians disdain multinationals, particularly publicly traded ones, for prioritizing short-term profits over American interests. Their disdain only deepens when you add the fact that many of them see multinational corporate America as caving to the “woke mob” and embracing DEI initiatives. As Trump supporter and former senator and attorney general Jeff Sessions wrote, “The globalists were like the Lilliputians, using their many strings to bind the giant Gulliver (e.g., the United States).”

In contrast, the Trumpian worldview celebrates capitalists who are loyal, good, and patriotic—those working daily to make America great again. These “uninationals” are manufacturers (and ranchers and farmers) who own their businesses and produce goods right here in the good ol' U.S. of A. These are the real patriots. These are the businesspeople that trade policy needs to foster and protect. This perspective explains why Trump stated, “Tariffs are not just about protecting American jobs, they're about protecting the soul of our country. Tariffs are about making America rich again and making America great again.” In this worldview, there is something deeply anti-American about both non-Americans and the U.S. globalist cabal that, in their eyes, has led the United States to the terrible predicament it’s currently in.

But there are heroes in this story, and their Washington home is the Coalition for a Prosperous America (CPA), a trade association and advocacy group formed in 2007 by Michael Stumo. CPA describes itself as:

“The only national non-profit organization representing exclusively domestic producers across many sectors and industries of the U.S. economy. We are an unrivaled coalition of manufacturers, workers, farmers, and ranchers working together to rebuild America for ourselves, our children, and our grandchildren. We value quality employment, national security, and domestic self-sufficiency over cheap consumption.”

As such, its members include domestic producers like Hewes Fastener, a screw manufacturer; Council Tool, a maker of axes and related professional tools; and Welborn Cabinet, a manufacturer building American-made cabinets. CPA’s members are generally low- to mid-tech companies selling products that face intense global competition and desperately seeking protection.

Along with other nationalist protectionists like Peter Navarro, Trump brought Stumo into his cabinet as Associate Director for Economic Policy and the Made in America Office at the Office of Management and Budget (OMB), where he reports to OMB Director Russ Vought.

Many of these folks are not just passionate, they are riled up, seeing the world in Manichean terms. You are either a patriot or a traitor; a soulless globalist or a nationalist. For many, there is no middle ground. This is a war for the survival of the Republic against globalists and their lackeys who would sell out America. As such, theirs is a take-no-prisoners approach.

To be sure, over the last two decades, Washington globalists have contributed to the nationalists’ sense of righteous anger by mocking and reviling them. As one leading Trumpian told me just this week, “Rob, for years, we protectionists were seen as being on the same level as pedophiles; now we are in charge.” Trump himself experienced this treatment as far back as the early 1990s, when he warned that America was losing. Like many who have been mocked and rejected, these nationalists have a long memory of humiliation. And now, with Trump, the chickens have come home to roost—they can call the shots and give the globalists their rightful due.

What’s Behind Their Thinking? - Revenge is not the only, or even the primary, reason for the new trade world Trump wants to build. It stems from fundamental views on how the global economy works and what America should do.

First, trade deficits equal a loss of wealth. President Trump equates a trade surplus with prosperity and deficits with poverty. In reality, trade deficits reflect excess short-term U.S. consumption in exchange for debt. And the most important factor in determining U.S. wealth is domestic productivity across all sectors, not just agriculture and manufacturing.

Second, all goods-producing sectors are created equal. Like free-market globalists, they think, “Computer chips, potato chips—what’s the difference?” The former meant that no sector was more important than another. Trumpian protectionists take the same view—but apply it to manufacturing. To them, a company that casts metal hammers is no less important than one that manufactures 3 nm semiconductors. A firm that makes t-shirts is just as important as a company that produces jet airplanes. A farmer raising chickens or growing rice is as vital as a firm producing life-saving drugs. In their view, it’s all manufacturing, and it all employs the sainted blue-collar worker.

Third, there is no difference between “friend” and “foe.” In their America First approach, traditional alliances don’t matter. The only thing that matters is the extent to which the administration believes a nation is taking advantage of America. That is why they can impose a 32 percent tariff on all imports from Taiwan while imposing only a slightly higher tariff of 34 percent on China, as both run trade surpluses with America.

Fourth, America must be self-sufficient. Trumpian protectionists refuse to accept a world in which America cannot make everything it needs—just as it supposedly did before World War I, at what Trump sees as the height of American greatness. When he threatened tariffs on Canada, he argued that the U.S. doesn’t need their imports because we can make everything domestically. The reality, of course, is that this is impossible. But in their world, it is not.

Fifth, global markets aren’t necessary. Building on the point above, they reject the idea that some industries, particularly those advanced industries with high fixed costs relative to marginal costs, need global markets to thrive. In their view, the U.S. economy is more than big enough to enable firms to succeed without relying on foreign consumers. Try telling that to Boeing, Merck, or Intel, who will likely face steep tariffs on their exports as other nations would retaliate, closing their markets to America.

Finally, the playing field must be absolutely even. In the Trumpian trade worldview, any imbalance in competition is an absolute disadvantage. In their minds, there is simply no way to compete with a nation that pays lower wages than the U.S., even if that country’s worker productivity is lower. Of course, that belief is wrong.

Excerpted with edits; more at: https://itif.org/publications/2025/04/04/liberation-day-explaining-trumps-tariffs/

OTHER STORIES:

7. CUTTING THE MEP PROGRAM FOR SMALL MANUFACTURERS

“Trump and DOGE Defund Program that Boosted American Manufacturing for Decades,” Paresh Dave and Louise Matsakis, Wired, April 2, 2025

At the height of the US trade war with Japan in the 1980s, Congress established a nationwide network of organizations to advise small American manufacturers on how to survive and grow in what was then a particularly difficult environment. Decades later, there is now at least one Manufacturing Extension Partnership (MEP) center in all 50 states, and they continue to provide taxpayer-subsidized consulting to thousands of businesses, including makers of ovens, printers, tortillas, and dog food.

But on Tuesday, shortly before the president announced sweeping tariffs on global imports, Trump administration officials informed members of Congress that it was withholding funding for some MEP centers because their work no longer aligns with government priorities. The Department of Commerce’s National Institute of Standards and Technology (NIST), which administers the program to help manufacturers, emailed lawmakers to say that it would not be paying out nearly $12.9 million that had been due overall this week to MEP centers in 10 states, according to Democratic staff of the House Committee on Science, Space, and Technology who spoke on the condition of anonymity.

The email from NIST stated, “The department is reprioritizing its programmatic activities to ensure that the US secures its position as a leader in critical and emerging technologies such as artificial intelligence and quantum. As such NIST has determined that these cooperative agreements are no longer aligned with the priorities of the department and NIST.”

The Democratic congressional aides and heads of MEP centers in multiple states believe that abandoning support for the program runs counter to Trump’s long-standing goals of boosting domestic manufacturing and winning the ongoing trade war with China. While the president has demonstrated a preference for punitive measures such as tariffs over subsidies to increase American manufacturing capacity, his defunding of the centers could leave US small businesses without the support they need to take advantage of such policies, advocates for the MEP program say. “These efforts directly align with the president’s goals to strengthen domestic manufacturing and re-shore production,” says Jennifer Sinsabaugh, CEO of New Mexico MEP.

Project 2025, a proposed road map for the current Trump administration authored by the conservative Heritage Foundation think tank, had called for eliminating federal subsidies for the manufacturing program and letting the private sector “more properly” carry out its business advisory services. But as of Wednesday, the Department of Commerce and NIST had not announced a plan to privatize it or shared how the withheld funds would be repurposed.

Excerpted with edits; more at: https://www.wired.com/story/nist-trump-manufacturing-extension-partnership/

8. IS AN INTEL-TSMC DEAL ON INTEL’S CHIP FABS IMMINENT?

“Intel, TWMC recently discussed chipmaking joint venture, the information report,” Reuters, April 4, 2025

Intel and Taiwan Semiconductor Manufacturing Co (TSMC) have recently discussed a preliminary agreement to form a joint venture to operate the U.S. chipmaker's factories, the Information reported on Thursday, citing two people involved in the discussions. TSMC, the world's largest contract chipmaker, will take a 20% stake in the new company, the report said. The White House and Commerce department officials have been pressing TSMC and Intel to strike a deal to resolve the long-running crisis at Intel, the report added. Intel and TSMC declined to comment, while the White House did not immediately respond to a Reuters request for comment.

Intel reported 2024 net loss of $18.8 billion, its first since 1986, driven by large impairments. Last month, TSMC said at a press event that it plans to make a fresh $100 billion investment in the U.S. that involves building five additional chip facilities.

[Such an arrangement could involve major national security issues for the US, since TSMC likely would keep its R&D and design capability in Taiwan but apparently operate Intel’s fabs. Production would likely shift to TSMC’s chips and Intel would drop its promising 18A advanced chip that it is now trying to scale into production. This would reaffirm TSMC’s increasing monopoly control of advanced chips.]

Excerpted with edits; more at: https://www.reuters.com/technology/intel-tsmc-tentatively-agree-form-chipmaking-joint-venture-information-reports-2025-04-03/

8. ECONOMIC INEQUALITY IS DRIVING GLOBAL POPULISM – WHERE IS IT NOW IN THE US?

“Economic Inequality – The Top 10%” Federal Reserve report, March 21, 2025

One of the strongest drivers of global populism is the perception that the system is rigged in favor of the rich /establishment /elite. New Federal Reserve data shows that wealth, income and spending inequality gaps persist and are growing.

8. MORE ON ECONOMIC INEQUALITY

“America Has Never Been Wealthier. Here’s Why it Doesn’t Feel That Way,” Talmon Smith, NY Times, March 31, 2025

U.S. household net worth reached a new peak at the end of 2024. The unemployment rate has levitated just above record lows for three years. The overall debt that households are carrying compared with the assets they own is also near a record low. The U.S. economy remains deeply unequal, with vast gaps in wealth and financial security persisting even as inflation has ebbed and incomes have risen. And data designed to capture the overall population may be obscuring challenges experienced by a broad range of Americans, especially those in the bottom half of the wealth or income spectrum.

The share of wealth held by families in the top 10 percent has reached 69 percent, while the share held by families in the bottom 50 percent is only 3 percent, according to the latest reading from the nonpartisan Congressional Budget Office. (When future income claims from Social Security benefits are included, the bottom 50 percent hold 6 percent of total wealth.)

Despite the growth in overall wealth, economic confidence among American households has not returned to where it was before the pandemic. That was the case even before consumer sentiment readings — along with the stock market — were dampened by the prospect of an inflationary global trade war from President Trump’s tariff campaign. But what is also striking in the data is the increasing gap in perceptions along income lines.

Over the past four years, the University of Michigan’s monthly survey of consumer sentiment has shown those in the bottom two-thirds of income to be deeply pessimistic about the economy — with rock-bottom ratings more common during periods of deep recession, including the 2008 financial crisis.

Excerpted with edits; more at (paywall): https://www.nytimes.com/2025/03/31/business/economy/wealth-cash-inequality.html

Since 2022, MIT has formed a vision for Manufacturing@MIT—a new, campus-wide manufacturing initiative directed by Professors Suzanne Berger, A. John Hart, and Christopher Love that convenes industry, government, and non-profit stakeholders with the MIT community to accelerate the transformation of manufacturing for innovation, growth, equity, and sustainability. Manufacturing@MIT is organized around four Grand Challenges:

1. Scaling advanced manufacturing technologies

2. Training the manufacturing workforce

3. Establishing resilient supply chains

4. Enabling environmental sustainability and circularity

MIT’s Bill Bonvillian and David Adler edit this Update. We encourage readers to send articles that you think will be of interest to us at mfg-at-mit@mit.edu.

Subscribe to Manufacturing@MIT’s Substack

Insights from articles and reports of interest on manufacturing technology, management, policy, and economics in the US and abroad