Manufacturing Update - 30 June 2025

Insights from articles and reports, excerpted and summarized, of interest on manufacturing technology, management, policy, and economics in the US and abroad.

Content:

1. WHAT’S THE NIPPON-US STEEL DEAL? “Nippon’s US Steel Acquisition by the Numbers”

2. WHERE ARE THE ROBOTS? “Trump’s Dream of Tariff-Driven Factory Boom Ignores the Labor Crunch”

3. CRITICAL MINING: “It’s Time to Mine: Securing Critical Minerals”

4. NEW CRITICAL TECH INDEX: “Introducing the Critical Technologies Index – Ranking Global Tech Power Across AI, Biotech, Semiconductors, Space and Quantum”

5. WHY DOES CHINA KEEP BUILIDNG INDUSTRIAL STRENGTH? “Chinese Industrial ‘Maximilism’: Lu Feng”

6. CHINA’S UNPROFITABLE CHAMPIONS: “China’s Industrial Policy has an Unprofitability Problem”

7. WHEN EUROPE INNOVATES IN CHINA: “The Tradeoffs of Innovating in China in Times of Global Technology Rivalry”

1. WHAT’S THE NIPPON-US STEEL DEAL?

“Nippon’s US Steel Acquisition by the Numbers,” Kate Magill, Manufacturing Dive, June 20, 2025

Nippon Steel announced a finalized agreement this month to buy U.S. Steel for nearly $14.2 billion. The impact of the highly anticipated deal is set to reverberate across the domestic steel industry. The combined company will be the fourth-largest steel producer in the world, with an annual capacity of 86 million tons.

Nippon committed to investing $11 billion in the U.S. by the end of 2028, with projects planned across Alabama, Arkansas, Indiana, Minnesota and Pennsylvania that promise to “protect and create” 100,000 jobs. The Japanese steelmaker’s planned investments across the six locations include:

$3.1 billion for the Gary Works mill in Gary, Indiana

$3 billion for the Big River Steel facility in Osceola, Arkansas

$2.4 billion for the Mon Valley mill in Mon Valley, Pennsylvania

$1 billion for a mini mill in an undecided location

$800 million for the Minntac and Keetac mines in northern Minnesota

$500 million for the Fairfield Works mill near Birmingham, Alabama

As part of these projects, Nippon will establish a research and development center in Pennsylvania, a pipe and tube mill in Alabama, an electric arc furnace mini mill in Arkansas and the expansion of a direct reduced grade pellet plant in Minnesota.

It will also make upgrades to its blast furnace mills in Indiana and Pennsylvania, as well as construct a new steel mill project. The investments will be “primarily funded through U.S. Steel’s enhanced cash generation,” according to a Nippon presentation.

Excerpted with edits; more at: https://www.manufacturingdive.com/news/nippon-us-steelacquisition-m-and-a-by-the-numbers/751176/

2. WHERE ARE THE ROBOTS?

“Trump’s Dream of Tariff Driven Factory Boom Ignores the Labor Crunch,” Brooke Sutherland, Bloomberg April 4, 2025

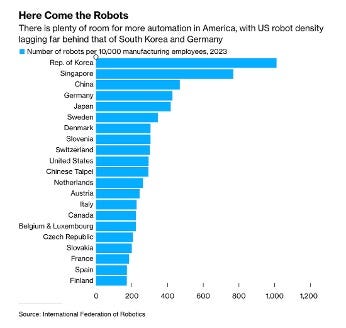

Whereas the Trump administration assumes (as Commerce Secretary Lutnick puts it) that millions of “nimble fingered workers” screw together smartphones in China and when manufacturing is moved to the US it will be characterized by high-tech robots tended by highly trained engineers, in fact China already had more than 50 percent more robots per manufacturing employee than the US … and that was back in 2023.

Excerpted with edits; more at (paywall): https://www.bloomberg.com/news/newsletters/2025-04-04/trump-s-tariff-driven-us-factory-push-ignores-labor-shortage

3. CRITICAL MINING

“It’s Time to Mine: Securing Critical Materials,” Ryan McEntush and Erin Price-Wright, Andreesen Horowitz, March 29, 2025

Critical minerals are the quiet enablers of modern power. They sit at the heart of technologies that define contemporary life and security, including electric vehicles, satellites, precision-guided weapons, batteries, and more. They are called “critical” not merely because of their unique properties or limited substitutes, but because the supply chains that deliver them are fragile. They stretch across continents and are vulnerable to geopolitical maneuvering, trade dependencies, and the erosion of industrial capacity.

Unlike bulk commodities such as iron or copper, many critical minerals are not extracted in high volumes as primary targets. Instead, they are typically recovered as byproducts or sourced from complex ore bodies that demand specialized processing. Their scarcity isn’t always geological; it’s often logistical, technical, political, and, most of all, economical. As an old quip has it: rare earths are not actually rare — just rarely worth the trouble.

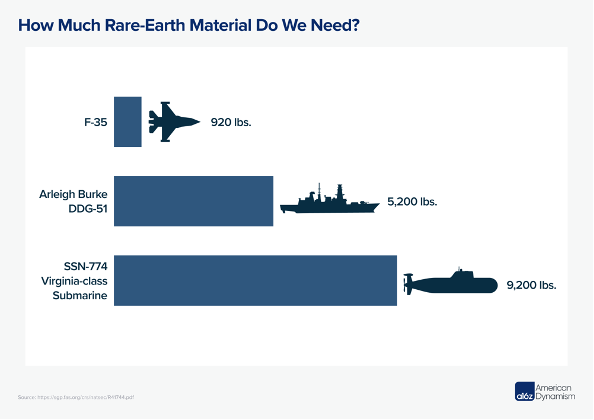

In many cases, though, there are no viable substitutes for these minerals in their most critical applications. Rare earth magnets, for example, remain unmatched in efficiency; lithium-ion batteries still lead in energy density and commercial readiness. In 2022, the United States government officially designated 50 “critical minerals,” and some of the most strategically significant — including rare earths, lithium, cobalt, nickel, graphite, copper, and uranium.

Mining 101: Value in mining flows through a series of distinct industrial stages — exploration, extraction, processing, and manufacturing — each with its own technical demands and economic logic. Firms typically specialize in a piece (or pieces) of the chain, shaped by differences in expertise, capital requirements, and risk. The chart summarizes the stages of risk:

Processing: Chemical processing is the most technically demanding and capital-intensive step in the critical minerals supply chain. It’s where raw concentrates — from ore, brine, or slurry — are refined into high-purity compounds and metals used in batteries, magnets, and other advanced technologies. Processing has also become the key bottleneck in the global minerals race — complex, capital-intensive, under-digitized, and central to everything downstream.

China dominates the processing market, controlling most global refining for lithium, rare earths, nickel, graphite, and cobalt. Its edge today comes from scale, industrial clustering, deep talent networks, offtakes, and years of operational experience. Replicating this in America is hard because permitting is slow, capital is expensive, and the talent pool is shallow. Additionally, volatile market prices pose existential risks to early-stage projects, while long development timelines leave them vulnerable to black swan events.

Manufacturing: The final stage is the manufacturing of advanced materials — battery precursors and active materials, magnets, and specialty alloys — that feed directly into end-use industries. Here, processed metals are transformed into engineered forms with unique chemical, structural, and magnetic properties. It’s the most specialized link in the chain, and perhaps the most strategically critical.

For countries aiming to reshore supply chains, the manufacturing stage is surprisingly difficult to replicate. It’s compact in footprint, but dense in know-how and risk. While policy often focuses upstream — what’s mined or refined — true independence depends on mastering this final stretch. Without it, the chokepoint simply moves downstream.

This isn’t assembly-line work, but precision materials engineering. Processes like heat treatment, doping, sintering, and nano-structuring push performance limits. Minor deviations in particle size or crystal structure can affect battery cycle life or magnet strength. Specs are tight, recipes proprietary, and tolerances unforgiving.

What America needs is a mining champion: a software-native, product-driven company that treats mining and metals as a systems engineering challenge. For this company, processing is not a bottleneck, but the heart of the business. It must absorb risk, deploy unproven tools early, and architect an integrated platform with long-term customer agreements from day one. In doing so, it doesn’t just build a better mining company, but an industrial flywheel. One capable of compounding technology, scale, and operational learnings into durable advantage across multiple commodities. And one that can grow into the technology-enabled, integrated major needed to challenge China’s lead.

Presently, though, most major mining firms are industrial relics — fifty, even a hundred years old. Decades of operation have bred competence, but also inertia. There’s a deep resistance to reinvention and risk. In the last twenty years, in fact, only China has produced new mining giants. Among them, Ganfeng Lithium stands out not just for its rapid scale but its strategy. Ganfeng didn’t start as a miner. It began as a downstream processor, specializing in the production of high-purity lithium products. From that foundation, it moved upstream into extraction to secure feedstock.

Its edge wasn’t capital or government alignment, but a technology-first mindset. Ganfeng was an early adopter of advanced refining techniques and direct lithium extraction (DLE), favoring scaled deployment over prolonged piloting. Critically, it treated technology not as a support function, but as the product itself. This tight integration — spanning resource access, chemical conversion, and broader system-level engineering — enabled faster iteration and helped Ganfeng quickly reach global dominance in lithium markets.

The United States can’t afford to pursue domestic critical mineral revival through piecemeal innovation. We can’t patch legacy systems with isolated, bespoke technologies and hope they cohere into a scalable, durable industry. That model breeds fragile businesses — structurally weak, exposed to commodity whiplash, and dependent on volatile capital markets. It doesn’t scale, it doesn’t compound, and it won’t beat a Chinese Communist Party armed with state-owned enterprises and guidance funds. The only credible answer is an American mining champion — vertically-integrated, technology-enabled, and built to win.

Of course, the United States government, too, has a critical role to play:

Streamline permitting and clarify regulations: Accelerate project timelines by reforming NEPA and CEQA processes, reducing uncertainty, and creating clearer pathways for development.

Provide non-dilutive financing and demand-side support: Use tools like grants, loan guarantees, offtake agreements, and tax credits to de-risk early-stage projects, attract private capital, and build long-term market confidence.

Coordinate with allies on supply chain strategy: Ore bodies and processing capabilities span borders. By aligning standards, pooling resources, and sharing data, allied nations can reduce strategic dependencies and strengthen collective resilience.

Align federal support for critical minerals: Align priorities across agencies by streamlining mandates, reconciling inconsistent mineral lists, and clarifying roles to deliver more cohesive, effective policy.

Excerpted with edits; more at: https://a16z.com/its-time-to-mine-securing-critical-minerals/

4. NEW CRITICAL TECH INDEX

“Introducing the Critical Technologies Index – Ranking Global Tech Power Across AI, Biotech, Semiconductors, Space and Quantum,” Eric Rosenbach, Lea Balthussen, Eleanor Crane and Ethan Kessler June 5, 2025

Key findings:

· The United States leads China and Europe in all sectors of the Index, primarily because of the unique innovation ecosystem that it has developed over the past several decades. U.S. performance is largely powered by economic resources and human capital, reflected in the scale of American public and private investment and its heterogeneous research workforce. The country’s decentralized innovation ecosystem—where resources, ideas, and authority are distributed across a myriad of government entities, universities, start-ups, and corporations—enables actors to expediently pool expertise and scale innovations.

· Although China still trails the United States, it remains competitive and is closing the gap across several sectors. China lags in semiconductors and advanced AI due to reliance on foreign equipment, weaker early-stage private research, and shallower capital markets, but it is far closer to the United States in biotechnology and quantum, where its strengths lie in pharmaceutical production, quantum sensing, and quantum communications. Backed by economic resources, human capital, and centralized planning, China is leveraging scale to reduce dependence on imports, attract innovation within its borders, and boost industrial competitiveness.

· Europe is competitive in critical and emerging technologies relative to the U.S.-China duopoly. Europe is third in the context of AI, biotechnology, and quantum technologies. Yet China and Russia outpace Europe in space, and China, Japan, Taiwan, and South Korea eclipse Europe in semiconductors. Indeed, Europe’s shortcomings with semiconductors significantly lower Europe’s overall standing compared to the United States and China. The region’s ability to fulfill its technological potential will ultimately depend on the integration of governance and capital across the region.

· Collaborative partnerships with Europe, Japan, and South Korea make the United States significantly more powerful in critical and emerging technologies, particularly in the context of quantum, semiconductors, and biotechnology. The United States is powerful across all sectors but does not have full supremacy; for instance, no country has complete, end-to-end control of a supply chain for advanced semiconductors. These gaps create critical chokepoints, limiting the ability of any one country to shape the global balance of power alone. To ensure that the West remains competitive and resilient, the United States must deepen collaboration with its allies and partners.

· The United States has a considerable advantage in AI, but China and Europe have made significant progress and have unique advantages that will challenge the American AI lead in the next decade. The United States dominates in terms of its economic resources, computing power, and algorithms. The 2025 release of DeepSeek’s R1 model and Alibaba’s Qwen3 family of models, however, demonstrated that the U.S. lead in AI may be more vulnerable than previously assumed. China leads in terms of data and human capital; these advantages will help it close the U.S. edge in AI if it can overcome the obstacles presented by U.S. export controls. Europe’s strength in AI is largely derived from its strong data and human capital, giving it the potential to accelerate its AI capabilities if it improves its regulatory environment.

· Among the technologies examined in this Index, China has the most immediate opportunity to overtake the United States in biotechnology; the narrow U.S.-China gap suggests that future developments could quickly shift the global balance of power. The United States and China perform similarly in biotechnology overall, with China’s strengths underpinned by its human capital. The United States excels in security, genetic engineering, vaccine research, and agricultural technology, bolstered by private-sector innovation and public-private partnerships. China has dominance in pharmaceutical production through extensive, large-scale public investments and state-backed manufacturing.

· The dominance of the United States, Japan, Taiwan, and South Korea in semiconductors persists at critical chokepoints of the supply chain: advanced manufacturing and fabrication, chip design and tools, and equipment. These pillars have the greatest variance among all included in this Index due to high costs and technical barriers. While many countries are investing heavily to close these gaps, capital alone is unlikely to be sufficient to establish an end-to-end semiconductor production capability; if countries aim to break free from dependence on the current leaders, they will need to simultaneously secure equipment and design intellectual property.

· The American private sector drives the United States’ strong lead in space, though its vulnerabilities in orbit to Chinese and Russian military capabilities increase strategic risk. Washington’s edge stems from productive public-private partnerships that have helped the United States dramatically increase its launch frequency and payload capacity while reducing per-mission costs. However, the United States is asymmetrically vulnerable in space, relying heavily on space-based systems for military operations and for supporting critical sectors of the American economy. China and Russia are also fielding formidable anti-satellite capabilities, offsetting the United States’ lead in space and increasing its strategic exposure.

Quantum technologies remain in an early research phase, with current efforts focused less on deployment and more on advancing early-stage concepts. This relative lack of investment has contributed to the fragmented and region-specific development of quantum ecosystems. In the United States and Europe, universities lead foundational research, startups develop specialized tools and systems, and large corporations scale engineering and infrastructure for quantum technologies. China takes a more opaque, state-led approach, with less separation between research, development, and industry.

Excerpted with edits; source at: https://www.belfercenter.org/critical-emerging-tech-index

5. WHY DOES CHINA KEEP BUILDING INDUSTRIAL STRENGTH?

“Chinese Industrial ‘Maximilism’: Lu Feng,” Kyle Chan, Thomas D Geddes and Ailsa Brown, High Capacity, June 19, 2025:

Lu Feng is a renowned professor at Peking University’s School of Government, specializing in industrial policy, technological innovation, and development. Lu’s influential theories of industrialization and development make him a modern-day Friedrich List or Alexander Hamilton. In a recent interview (summary below), Lu Feng presents a theory of what could be called “Chinese industrial maximalism.” At a time when China is already the world’s manufacturing superpower and faces accusations of “overcapacity” from the US and EU, Lu Feng argues that what China needs is more industrial development, not less. There are two main reasons for this.

1) Industrial capacity as a driver of technology

The first is that having a large and diverse industrial base is a key precondition for scientific and technological innovation. He argues that “only after becoming an industrial power can a country become a scientific power.” Lu Feng points to the historical examples of the US and Japan, which began by mass-producing goods that were invented elsewhere, like cars. The industrial capacity that emerged later generated both the demand and resources needed for scientific innovation, including the creation of entirely new industries, such as semiconductors, computers, and software.

Lu Feng argues that the larger and more diverse a country’s “industrial system”—which includes not just different sectors but also supporting factors such as education and financing—the faster its technological advancement. “Complementary relationships” within the industrial system allow technological advancements in one sector to drive progress in others. For example, China’s advances in lithium batteries and lidar sensors empower its EV, drone, and robotics industries through what I call “overlapping tech-industrial ecosystems.” In a similar manner, Lu Feng believes China’s vast industrial base will give it an edge in AI through a positive feedback loop between real-world industrial applications and foundational AI models.

2) Industrial capacity as a source of power

The second reason for doubling down on industrial development is the geopolitical value of China’s industrial base. Lu Feng argues that China’s industrial base is its “greatest source of strength” and a “strategic asset” akin to US dollar hegemony or Russian oil and gas. The fact that the whole world relies on China’s manufacturing capabilities and finds it nearly impossible to replicate this elsewhere makes China an indispensable part of the global economy.

This gives China geopolitical leverage, a point made clear in the trade war with the US. President Trump’s escalation of tariffs on China backfired by revealing how dependent the US was on Chinese manufactured goods, such as smartphones and batteries. The White House was forced to quickly follow up with tariff exemptions for these very categories. (China also quietly put out its own list of tariff exemptions.) Over time, China has sought to decrease its reliance on foreign technology, especially American technology, while increasing the rest of the world’s reliance on China, as Ryan Hass at Brookings has pointed out.

A contest between two systems

Lu Feng argues that China’s industrial development is more important than ever in the face of intensifying US-China competition. Rather than caving into notions of “overcapacity” coming from “foreign influences” and “tying our own hands” by limiting industrial capacity, Lu says China should forge ahead in both traditional and high-tech industries. This is especially critical now as he believes the “US is gearing up for a showdown with China”.

Lu Feng sees the US-China rivalry ultimately as a contest between two systems: China’s “industrial socialism” and America’s “financial capitalism” The US was once an industrial powerhouse like China today with half of global production and an “arsenal of democracy” that changed the course of World War II. But, in a critique with strong political resonance within the US, Lu Feng says the US economy became increasingly “financialized” dominated by the short-term interests of Wall Street investors, causing America’s industrial base to atrophy. In contrast, China’s socialist system ensured that financial resources would be directed toward supporting the “real economy” and steer China away from the standard path of deindustrialization.

Lu Feng ends with a bold statement: “The past 500 years of world history show that an industrial power has never lost when challenged by a financial power, even when the financial power is also a global hegemon.” For Lu, the answer to China’s core challenges—strategic rivalry with the US, sustaining technological progress, an economic slowdown, employment—is even greater industrial strength in every form.

Excerpted with edits; more at: https://www.high-capacity.com/p/chinese-industrial-maximalism

6. CHINA’S UNPROFITABLE CHAMPIONS

“China’s Industrial Policy has an Unprofitability Problem,” Noah Smith, Noahopinion, June 20, 2025

Until the mid to late 2000s, China didn’t really have a national industrial policy as such. It had a bunch of local governments trying to build up specific industries, usually by attracting investment from multinational companies. And it had a central government that tried to make it easy for local governments to do that, using macro policies like making sure coal was cheap, holding down the value of the Chinese currency in order to stimulate exports, and so on.

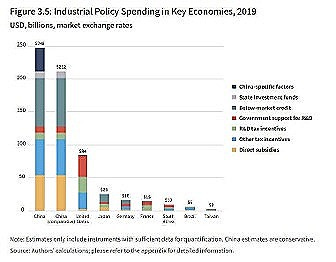

But it was not until the end of Hu Jintao’s term in office — and really, not until Xi Jinping came to power — that China developed anationalindustrial policy, in which the government tries to promote specific industries using tools like subsidies and cheap bank loans. If you want a good primer on just how big those loans and subsidies are, and which industries they’re going to, I recommend CSIS’ 2022 report, “Red Ink: Estimating Chinese Industrial Policy Spending in Comparative Perspective”. It’s a lot. Below are the authors’ estimates from 2019:

In some respects, this policy was successful. For example, it moved China up the value chain — instead of doing simple low-value assembly for foreign manufacturers as in the 2000s, China in the 2010s learned to make many of the higher-value components that go into things like computers, phones, and cars, as well as many of the tools that create those goods. This had the added security benefit of making China less dependent on foreign rivals for key manufacturing inputs.

China has doubled down on its centralized, big-spending industrial policy since then. In 2021-22, China suffered a huge real estate bust, crippling a sector that had accounted for almost one third of the country’s GDP. China’s leaders responded by doubling down on manufacturing, encouraging banks — essentially all of which are either state-owned or state-controlled — to shift their lending from real estate to industry.

Along with this industrial policy, you saw a massive surge of Chinese manufactured exports flowing out to the rest of the world. The most recent export surge has been labeled the “Second China Shock”, but in fact the trend was already headed in that direction well before the pandemic. China’s competitive success in manufacturing industry after industry has been nothing short of spectacular. In just a couple of years, China went from a footnote in the global car industry to the world’s leading auto exporter

But it’s important to remember that most of what China is producing in this epic manufacturing surge is not being exported. For example, take cars. Even though China is now the world’s top car exporter, most of the cars it makes are sold within China. In fact, this pattern holds across the whole economy. For an industrialized country, China is unusually insular — its exports as a percent of its GDP are higher than the U.S., but much lower than France, the UK, Germany, or South Korea.

Most of China’s enormous manufacturing subsidies are not actually for export manufacturing; they’re for domestic manufacturing. The rest of the world is just getting a little bit of spillover from whatever Chinese companies can’t manage to sell domestically — except for a country as huge as China, a “little spillover” can seem like a massive flood to everyone else.

And here lies the rub. Essentially, China is huge and most of its trading partners are pretty small. There’s a limited amount of Chinese cars, semiconductors, electronics, robots, machine tools, ships, solar panels, and batteries they can buy. And on top of that, some of China’s biggest trading partners are levying tariffs against it.

For most Chinese manufacturers, export markets are simply not going to replace the domestic market. And this means that Chinese manufacturers will be forced to compete against each other for a domestic market whose size is relatively fixed, at least in the short term. That competition will eat away at their profit margins.

The Chinese government pays a ton of different car companies to make more cars. Chinese banks, at the government’s behest, give cheap loans to a bunch of different car companies to make more cars. So they all make more cars — more than Chinese consumers want to buy. So they try to sell some of the extra cars overseas, but foreigners only buy a modest amount of them. Now what? Unsold cars pile up, prices are cut and cut again, and all the car companies — even the best ones, like BYD — see their profit margins fall and fall.

It’s not just autos, either — similar things are happening insolar,steel, and a bunch of other industries. Manufacturing profit margins are plunging across China’s entire economy:

There are several problems. The first is macroeconomic. Price wars across much of the economy create deflation. In fact, China is already experiencing deflation. On top of that, a massive wave of bankruptcies could cause a second bad-debt crisis on top of the one that’s already happening from real estate. Wei Jianjun of Great Wall Motor has been warning of exactly this happening. In fact, we can already see Chinese banks beginning to slow the torrid pace of industrial loans they were dishing out a couple of years ago.

There are also microeconomic dangers from overcompetition. Competition could spur Chinese companies to just innovate harder. But if China’s top manufacturers are constantly skating on the edge of bankruptcy, that means they’ll have fewer resources to invest in long-term projects like technological innovation and new business models. Basically, prices are signals about what to build, and China’s industrial policies are sending strong signals of “build more stuff today” instead of “build better stuff tomorrow.”

There’s also the danger that China’s government won’t allow the price wars to end. Ideally, you’d want these price wars to be temporary; eventually, you’d want weak producers to fail, allowing top producers to increase their profitability. This good outcome relies on the government eventually cutting subsidies and letting bad companies die. But letting bad companies die means a bunch of people get laid off. Already, Bloomberg reports that economic protests are proliferating across the country; with the real estate crisis ongoing, the government will be under even more political pressure to keep manufacturing employment strong. This could mean keeping crappy companies on life support. These so-called “zombie” companies, kept alive only by a neverending flood of cheap credit, were a big part of why Japan’s economy slowed down so much in the 1990s.

China’s experience is illuminating a problem with industrial policy — the risk of vicious price wars and deflation, due to the subsidization of too many competing companies.

Excerpted with edits; more at: https://www.noahpinion.blog/p/chinas-industrial-policy-has-an-unprofitability

7. WHEN EUROPE INNOVATES IN CHINA

“The Tradeoffs of Innovating in China in Times of Global Technology Rivalry,” Jeroen Groenewegen-Lau and Jacob Gunter, MERICS, June 24, 2025

European companies remain highly interested in China’s technology and innovation ecosystem. However, they are also increasingly skeptical and concerned about the risks: China’s own techno-industrial agenda and fears of escalation of the technology war with the US.

Key findings from our report include:

Many European companies rely on China’s innovation ecosystem in their global research and development strategies, which over time can jeopardize their technology, often followed by a loss of market share in China, and eventually globally.

China’s policy approach is tailored to further its national interests, so foreign firms are met with different environments and incentives based on what they have to offer to China.

Those with strategic technology, like companies that are part of the semiconductor value chain, are courted. China wants to pull in their technology – foreign companies are at risk of losing market share once domestic competitors have caught up.

Firms in less strategic sectors like automotive or consumer goods receive fewer incentives but are also still accepted as providers of jobs and investment.

Foreign firms adjust to risks with a mix of localization, partial decoupling of China operations from global ones, offshoring R&D while tailoring other operations more to the China market. Such measures are protective but also bring disadvantages.

European tech and innovation policies are slow to adjust to technology challenges emanating from China.

European actors need to respond to the fact that Beijing strategically incentivizes foreign providers to enter China while limiting technology outflows where China is on the cutting edge.

Excerpted with edits; more at: https://merics.org/en/report/trade-offs-innovating-china-times-global-technology-rivalry#msdynmkt_trackingcontext=95917f3c-84ff-49f9-9ef8-74b60e410000

The MIT Initiative for New Manufacturing (INM) aims to redefine what’s possible in manufacturing. Through research, hands-on training, and deep industry collaboration, INM aims to build the tools, systems, and talent to shape a more productive, sustainable, and resilient future. INM is a campus-wide manufacturing effort directed by Professors Suzanne Berger, A. John Hart and Christopher Love that convenes industry, government, and non-profit stakeholders with the MIT community to accelerate the transformation of manufacturing..

MIT’s Bill Bonvillian and David Adler edit this Update. We encourage readers to send articles that you think will be of interest to us at mfg-at-mit@mit.edu.

Subscribe to the MIT Initiative for New Manufacturing Substack

Insights from articles and reports of interest on manufacturing technology, management, policy, and economics in the US and abroad