Manufacturing Update - 24 April 2025

Insights from articles and reports of interest on manufacturing technology, management, policy, and economics in the US and abroad

Content:

1. WILL AI ELECTRIFICATION BOOST POWER INDUSTRIES? “Rustbelt Gamble: GE Vernova rides AI power boom into uncertain future”

2. RARE EARTHS ACCESS IS INDUSTRY CHALLENGE: “China’s rare earths controls prompt fears of auto shortages and shutdowns”

3. BYD’S EV EXPANSION ENABLED BY ITS SPECIALIZED SEMICONDUCTOR BRANCH: “BYD Semiconductor - deep dive”

4. NVIDIA TRIES TO HEAD OFF TARIFF THREAT: “Nvidia’s Made-in-the-US move follows a familiar Trump Pattern”

5. CONGRESSIONAL PRESSURE HEADS OFF CUTS IN MANUFACTURING EXTENSION PARTNERSHIP (MEP): “Safeguarding the MEP Program is critical to revitalizing American manufacturing”

6. TARIFFS, RESHORING, AND THE TIME TO BUILD A FACTORY: “Trump’s ‘reshoring’ ambitions threatened by tariff chaos”

7. WILL TARIFFS REBUILD US MANUFACTURING? “Will Tariffs Drive Domestic Innovation?”

8. TARIFFS HIT SUPPLY CHAINS THAT ARE OFTEN VERY INTERNATIONAL: “Trump Announces 25% tariffs on car imports to US”

9. ANOTHER APPROACH: GERMANY CREATES HIGH-TECH MINISTRY: “Germany to create ‘super-high-tech ministry for research, technology and aerospace”

1. WILL AI ELECTRIFICATION BOOST POWER INDUSTRIES?

“Rustbelt Gamble: GE Vernova rides AI power boom into uncertain future,” Amanda Chu and Kasia Brussalian, Financial Times, April 20, 2025

In a corner of the American rustbelt, factory workers at GE’s former power business are betting a revival driven by the AI revolution will survive the global trade war and supply chain havoc unleashed by Donald Trump. GE Vernova, formed a year ago after the conglomerate’s break-up, is investing nearly $600mn to expand its former headquarters in Schenectady, in New York state, and other sites to make equipment for gas-fired power plants and to help overhaul the US’s aging electricity grid. The strategy aligns with the Trump administration’s push to reshore manufacturing and break the US’s reliance on overseas supply chains — especially China.

It is also part of a broader pivot to natural gas in an economy where artificial intelligence data centers are expected to need huge volumes of reliable, round-the-clock electricity — and the fossil fuels promoted by President Trump over renewables can supply it. These trends have supercharged GE Vernova’s share price, which tripled to a high of $438 in January following its April 2024 spin-off, after repeated losses from its troubled wind energy business.

But analysts warn that the post-spin off euphoria is under threat, as the efficiency gains made by China’s DeepSeek AI model leave investors wondering if the technology will need as much power as thought. GE Vernova’s shares have fallen by 26 per cent since hitting a peak on January 23, when Trump unveiled his $500bn Stargate project for AI. In addition to doubts over power projections, Trump’s attacks on renewable energy and his aggressive trade war have become potential problems for the company’s wind business and supply chains. After two decades of stagnation, US electricity consumption has risen to record highs and is expected to grow another 16 per cent by 2029, driven by AI data centers and onshoring, according to think-tank Grid Strategies.

That market dynamic has transformed GE Vernova’s gas turbine business. Orders for turbines doubled last year and the company is fully booked into 2028. Its electrification business, which produces grid equipment, has seen orders rise almost 20 per cent year-over-year. “We’re going into an investment supercycle,” Scott Strazik, GE Vernova’s chief executive, said in an interview last month. But the demand outlook is fraught with risk given the uncertainties around AI. The Electric Power Research Institute, for example, projects data centres could consume as little as 4.6 per cent of US electricity by 2030, up from just 4 per cent. But it also says the share could reach nearly 10 per cent. Meanwhile, the Department of Energy suggests demand could triple by 2028.

Excerpted with edits; more at (paywall): https://www.ft.com/content/474eb6e6-1ef3-48d5-8ea9-43211c611300

2. RARE EARTHS ACCESS IS INDUSTRY CHALLENGE

“China’s rare earths controls prompt fears of auto shortages and shutdowns,” Henry Dempsey. Camilla Hodgson, Kana Inagaki and Edward White, Financial Times, April 20, 2025

China’s latest export controls on rare earth minerals could cause shutdowns in automotive production, with stockpiles of essential magnets set to run out within months if Beijing fully chokes off exports. Beijing expanded its export restrictions to seven rare earth elements and magnets vital for electric vehicles, wind turbines and fighter jets in early April in retaliation for US President Donald Trump’s steep tariffs of 145 per cent on China. Government officials, traders and auto executives said that, with inventories estimated to last between three and six months, companies would be racing to stockpile more material and find alternative supplies to avoid major disruption. Jan Giese, a metals trader at Frankfurt-based Tradium, warned that customers had been caught off guard and most car groups and their suppliers appear to be holding only two to three months’ worth of magnets.

“If we don’t see magnet deliveries to the EU or Japan in that time or at least close to that, then I think we will see genuine problems in the automotive supply chain,” said Giese. China’s latest controls focused on “heavy” and “medium” rare earths that enable high-performance magnets that can withstand higher temperatures, such as dysprosium, terbium and samarium. These are vital for military applications such as jets, missiles and drones, as well as rotors, motors and transmissions that feature heavily in electric and hybrid vehicles.

A senior automotive executive said the critical mineral restrictions would be “consequential” for Tesla and all other car manufacturers, describing the export controls as a “7 or 8” on a scale of 1 to 10 in terms of severity. “It’s a form of retaliation where the Chinese government can say ‘OK, we’re not going to go tit-for-tat any more on the tariff rate but we will hurt you USA and we will incentivize companies to plead with your own home governments to change tariff policy,’ ” he said.

Rare earth metals are commonly found in the earth’s crust but are difficult to extract at low cost and in an environmentally friendly manner, with China commanding a near monopoly on heavy rare earths processing. The “light” rare earths, such as neodymium and praseodymium, used in larger quantities in magnets have not been targeted, giving Beijing a “big threat vector” to expand controls if the trade war intensifies, said Cory Combs of Beijing-based Trivium, a consultancy. Beijing’s controls require exporters to gain licenses for each shipment of material overseas and have expanded their scope to ban re-exports to the US. However, application of the curbs — which have covered a gradually expanding group of critical minerals since 2023 in response to US blocks on Chinese access to chip technology — has been far from universal. Chinese exporters have already declared force majeure on cargoes of rare earths and magnets heading overseas and have withdrawn material for sale from the market, further obscuring the price of already opaque commodities

Excerpted with edits; more at (paywall): https://www.bbc.com/news/articles/c5ypxnnyg7jo

3. BYD’S EV EXPANSION ENABLED BY ITS SPECIALIZED SEMICONDUCTOR BRANCH

“BYD Semiconductor - deep dive,” Moore and Morris, Nomad Semi, April 16, 2025

BYD was founded in 1995 as a battery manufacturer and quickly became a global leader in the rechargeable battery market. The company entered the automotive industry in 2003 by acquiring Xi’an Qinchuan Automobile Company. Leveraging its strength in battery technology, BYD pivoted toward electric mobility, becoming one of the earliest Chinese producers of Electric Vehicles (EV or known as NEV in China).

When looking at its power semiconductors, it is important to understand BYD as it is the largest EV producer globally. In 2024, BYD delivered 4.27 million electric vehicles (both battery electric vehicles [BEVs] and plug-in hybrid electric vehicles [PHEVs]), accounting for approximately 25% of global EV shipments. This figure is also 2.5 times more than Tesla’s 1.7 million units. China is the biggest EV market globally as it accounts for 65% (11.2 million units) of the global EV sales (17.1 million units).

BYD’s vertical integration is a major competitive advantage that underpins its leadership in the global EV market. Unlike most automakers, BYD produces nearly all critical components in-house: batteries, electric motors, semiconductors, vehicle platforms, and even the software that powers its cars. It owns BYD Electronics, which is a listed company that acts as a Tier 1 OEM for BYD. BYD is known to procure up to 70% of components from its in-house subsidiaries. This level of vertical integration is higher than Tesla’s, which still relies on external partners for batteries and semiconductors.

In addition to its scale, vertical integration allows BYD to become the lowest-cost producer. The status of lowest cost producer is critical for BYD to offer the most competitive pricing in the world. It can also drive a faster innovation cycle as we have seen recently with its Blade Battery and DM-i hybrid system.

Let’s take a closer look at BYD Semiconductor, one of BYD’s most important subsidiaries after its battery arm. BYD Semiconductor was first established in 2002 as a fabless design company to research battery protection integrated circuits. This was a year before it went into the automotive sector in 2003. Subsequently, it also went into microelectronics, optics and LED. Facing financial difficulties, BYD acquired Ningbo SinoMos in 2008. They knew that IGBT (insulated gate bipolar transistors – for power transmission) would be a key component for electric vehicle. Thus BYD Semiconductor went from a fabless company to an integrated device manufacturer (IDM) that oversees the entire production process from design to manufacturing. BYD is now a system company that incorporates the chips made from BYD Semiconductor in its EVs.

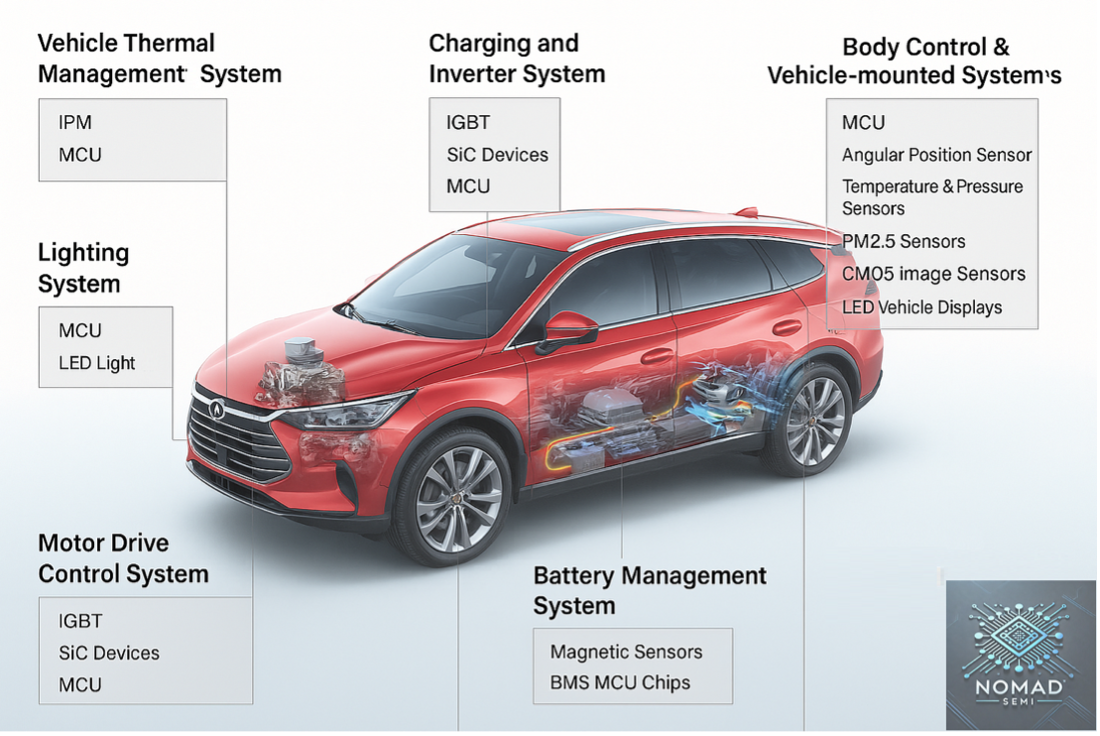

With more than 20 years of history, BYD Semiconductor has a wide product portfolio that can be broadly categorized as Power, MCU (micro controller unit), Sensor and Optoelectronics. This can cover most of the semiconductor requirement in an EV other than infotainment SoCs and autonomous driving processors. While BYD Semiconductor has centered its strategy around automotive applications, its products are also used in industrial settings, home appliances, consumer electronics and renewables.

BYD uses its semiconductor arm for the chips behind the extensive electronic elements in its vehicles:

Semiconductor applications have now become a key part of its technology leadership of the EV sector, making it hard to catch up with.

Excerpted with edits; more at: https://www.wired.com/story/the-electric-vehicle-fight-turns-to-california/

4. NVIDIA TRIES TO HEAD OFF TARIFF THREAT

“Nvidia’s Made-in-the-US move follows a familiar Trump Pattern,” Bradely Olson and Rolfe Winkler, Wall Street Journal, April 14, 2025

Chip designer Nvidia unveiled plans Monday to produce new made-in-America supercomputers that power artificial intelligence, just one day after the Trump administration said tariffs were coming for semiconductor-reliant imports. But just how much of Nvidia’s news was really new?

The chip maker said it would make AI supercomputers with contract manufacturers in Texas, its first public disclosure of a plan that would amplify ongoing U.S. efforts to bring semiconductor production back to domestic markets. A darling of the global AI boom, Nvidia promised an eye-popping $500 billion in spending in the coming years, an announcement that echoed a similar goal disclosed by Apple in February. The spending goal was no surprise to analysts, nor were Nvidia’s projections for “hundreds of thousands” of new jobs, but the AI manufacturing plans in the Lone Star state—which the company said it would achieve with Taiwanese partners such as Foxconn and Wistron—were a revelation.

Nvidia is joining the ranks of U.S. tech companies that are seeking to meet President Trump’s demands to revitalize the U.S. economy through manufacturing. In February, Apple said it would invest $500 billion in the U.S. over four years, a plan it touted would support 20,000 jobs and onshore some AI server manufacturing in Houston. As with similar announcements during Trump’s first administration, the companies haven’t said what volume of products or capacity they ultimately plan to reach. In 2019, Trump and Apple Chief Executive Tim Cook toured a facility in Austin where workers assembled Mac Pro computers. The site had been in operation since 2013. Trump touted it at the time as “the beginning of a very powerful, important plant.” Trump was quick to claim victory after Nvidia’s announcement Monday.

The comments followed a topsy-turvy weekend that started with the late-night release of tariff exemptions for electronics including the iPhone and laptops and ended with Commerce Secretary Howard Lutnick saying the exemptions weren’t permanent. He said tech products would soon be subject to sector-specific tariffs along with semiconductors. Nvidia hasn’t disclosed how much AI gear it will ultimately make in the U.S., but it said facilities in Texas, all of which would be new, are expected to increase production in 12 to 15 months. The company said it was producing its most advanced AI chips at a TSMC Co. plant in Arizona.

Excerpted with edits; source at (paywall): https://www.wsj.com/tech/nvidias-made-in-the-u-s-a-move-follows-a-familiar-trump-pattern-5401d6f0

5. CONGRESSIONAL PRESSURE HEADS OFF CUTS IN MANUFACTURING EXTENSION PARTNERSHIP (MEP)

“Safeguarding the MEP Program is critical to revitalizing American manufacturing,” Century Foundation, April 17, 2025.”

In a reversal that underscores both the political sensitivity and economic importance of U.S. manufacturing, the Trump administration is walking back its April 1 decision to zero out millions in funding for Manufacturing Extension Partnership (MEP) centers whose contracts were up for renewal in ten states. While the decision to cut funding was not a surprise—it hails straight from the “Project 2025” playbook, which calls for eliminating federal support for programs like the Manufacturing Extension Partnership—it triggered widespread alarm. [A letter from some 85 members of Congress opposing the move recently went to the Commerce Secretary.] The administration’s explanation to Congress that the investment was “no longer aligned with government priorities” left most analysts predicting the remaining states would see similar cuts as their funding renewal deadlines hit at quarterly intervals over the next twelve months.

While MEP funding for the ten state centers targeted is safe for now, the future of this support is definitely uncertain as small manufacturers and the centers that support them brace for further cuts as called for in the president’s proposed FY2026 budget.

Established in 1988 under the Omnibus Trade and Competitiveness Act in response to the 1980s trade pressures on US manufacturing, the MEP program is a public–private partnership administered by the National Institute of Standards and Technology (NIST). Its primary mission is to enhance the competitiveness of small- and medium-sized manufacturers (SMMs) by providing them with access to technology, resources, and industry best practices. MEP centers operate in all fifty states and Puerto Rico, offering services such as process improvements, workforce training, and supply chain optimization. The program is funded through a combination of federal appropriations, state dollars, and fees charged to client manufacturers.

Federal funding is the linchpin of MEPs, and the unilateral decision by the U.S. Department of Commerce appeared to be in direct conflict with a bipartisan appropriation of $175 million for fiscal year 2025. MEP has been targeted in the past for budget cuts by groups [led here by the Heritage Foundation] who believe that the government should not intervene in the private economy. Yet eliminating the program goes against the growing bipartisan understanding that a strong industrial base is necessary for economic competitiveness and national security. [However, the matter is not fully resolved, since the restored funding is only for six months of funding under a one-year cooperative agreement with the federal government.]

Excerpted with edits; more at: https://tcf.org/content/commentary/safeguarding-the-mep-program-is-critical-to-revitalizing-american-manufacturing/

6. TARIFFS, RESHORING, AND THE TIME TO BUILD A FACTORY

“Trump’s ‘reshoring’ ambitions threatened by tariff chaos,” FT reporters, Financial Times, April 9, 2025

From car factories to aluminum smelters, Donald Trump wants to bring manufacturing back to the US by waging the biggest trade war since the 1930s, but executives warn that tariff uncertainty will make it too risky to invest billions of dollars in building new American plants. “Reshoring” has been a top priority for the US president, with companies such as Apple, Diageo and Johnson & Johnson rushing to announce $1.9tn of investments in the US since his election, including bolstering their manufacturing capacity.

But the property search, design, and construction of a factory, along with permit applications and ordering robots and other manufacturing equipment, will mean plants take years to complete and many are unlikely to be finished before Trump’s second term expires. “It will take between three and 10 years in most cases to build a new manufacturing facility in the US,” said Erin McLaughlin, an economist at the Conference Board who has a design and construction background. “Everything takes time before you can get that picture of a congressman with a shovel in their hand,” she added. Companies looking to protect their supply chains may turn to domestic acquisitions instead of starting a new build, she said. “It might be faster to buy a company than to build a new plant.” Given the long and costly process to build a factory, many executives are wary of immediately pouring money into new facilities while uncertainty persists over whether Trump will stick to his trade policy.

“The building of a plant will take years and then it’s going to be around for decades so you have to have a very long-term view of where regimes will go,” said Mark Wakefield, global automotive market lead at AlixPartners. “You’re not going to make a long-term decision today because you’re going to want to let things settle and see a bit more how things go.” Market chaos unleashed by Trump’s tariff announcements last week has sparked criticism from billionaires such as investor Stanley Druckenmiller and Ken Langone, co-founder of Home Depot and longtime Republican donor, raising pressure to soften some of the levies.

In the case of cars, building a plant from scratch takes at least two to five years, according to industry executives. The time and cost depends on the size of the plant as well as whether key components such as powertrains and batteries will be produced in the same location. South Korea’s Hyundai has invested $12.6bn to build an electric vehicle and battery cell plant in Georgia, which took about two and a half years from signing the deal until production began in October 2024. The state of Georgia and the local joint-development authority initially acquired the land in 2021, with the view to wooing Hyundai.

Even for a smaller plant, reaching production at scale can be slow and expensive. Volvo Cars has invested about $1.35bn in its plant in South Carolina since it picked the location in 2015. The plant began production three years later and now has total annual production capacity of 150,000 vehicles, which some industry executives say is the minimum required to make it economically viable to build a new US plant.

Given the current uncertainty in the US, some companies may look to alternatives to building new factories. Wakefield said most carmakers had enough capacity at existing plants. It would also be cheaper to restart mothballed facilities than to build new ones from scratch. Labor costs in the US mean that the factories will depend heavily on automation but ordering equipment also takes time, and tariffs are also set to increase the cost of overseas materials and technology. General Motors told investors in February that it could not make decisions on where it would move its plants without policy clarity.

Trump has also declared his ambition to “resurrect the American shipbuilding industry.” The US is now a tiny global player compared to Asian nations. But experts say reviving American shipbuilding would require years of investment into new shipyards. The US has “zero” chance of becoming a significant shipbuilding nation during Trump’s second term, said Antonella Teodoro, a senior consultant at shipping advisory MDS Transmodal.

In metals production, the US had five active aluminum smelters in 2023, according to the US government. To compete globally on aluminum production, the US would need to build smelters that can produce up to 1m tons a year, said David Krakoff, a former executive at Kaiser Aluminum. “You are talking about seven years until you start to see hot metal,” he added, given the permits and financing required to build a smelter of that scale.

Excerpted with edits; more at: https://www.ft.com/content/d07d4ebe-c903-4178-bee6-a577913d43de

7. WILL TARIFFS REBUILD US MANUFACTURING?

“Will Tariffs Drive Domestic Innovation?” Willy Shih and Chigozie Ukachi, Harvard Business Review, April 2, 2025

In the race to dominate strategic sectors like batteries and electric vehicles (EVs), Chinese manufacturers like CATL and BYD are so far ahead of the rest of the world that they are becoming nearly impossible to challenge. A major reason is the cost advantage they’ve built by leveraging the large demand in their domestic market not just to achieve economies of scale but also to learn how to lower the costs of their production processes.

For companies trying to compete in this space—or in any other sector where high production volume is key to driving learning—understanding how they got here isn’t just useful; it’s necessary. Only then can they start to develop strategies to catch up and compete.

The global trade war that the Trump administration is on the verge of igniting promises to only complicate matters. In many cases, the only path forward may be to try to change the game—for instance, by creating process or product innovations.

The Learning Curve - Theodore P. Wright, an aeronautical engineer, first documented the phenomenon now known as the learning curve in 1936. He found that with each doubling of cumulative production, costs dropped at a predictable rate. Workers got faster as they learned by doing, processes became more efficient with the incorporation of new tools or methods, less expensive raw materials or components might be incorporated, and economies of scale kicked in. The learning curve received a lot of attention during World War II as U.S. government contractors sought ways to predict costs for building ships and aircraft.

In the 1960s, the Boston Consulting Group got behind this idea, and it led to the concept of forward pricing in technologies like semiconductors: price your products below costs in the early stages to build up volume sooner so you could go down the learning curve faster, driving down your costs. This principle has played out across many industries, from solar panels to chemical processing. Contract manufacturers historically have relied on it as they placed bids for work below their initial cost for producing a product, knowing that through learning and material substitutions they would get their costs down below their initial bid.

Lessons from the Lithium-Ion Battery Industry - What’s happening with lithium-ion batteries is instructive. Since their introduction, costs have plummeted. In the early 1990s, a kilowatt-hour of lithium-ion battery cell capacity cost about $7,500. In 2024, it dropped below $100. That kind of cost decline isn’t an accident. It happens because of technological advancements in materials—such as shifting from cobalt-heavy cathodes to cheaper lithium iron phosphate (LFP) chemistries. It happens because of manufacturing innovations like cell-to-pack (CTP) designs, which reduce unnecessary weight and materials. And it happens because of efficiencies arising from the sheer production scale. The more batteries a company produces, the more efficiently they can make the next one.

The big question is how much lower costs can go. The progress ratio, which measures how much costs decline every time cumulative production doubles, is currently estimated at around 0.80 or better. That means a 20% reduction in costs with each cumulative doubling of output. CATL has 38% of the global battery-manufacturing capacity (44% in China), and it installed enough capacity to produce 15 GWh of battery cells annually in February 2025 alone. (By comparison, Tesla’s Gigafactory Nevada produces around 37 GWh of battery cells annually.) CATL’s marginal cost of new capacity is likely so low that the chances of anyone catching up are getting lower every day.

Chinese battery companies can leverage the learning curve because they have demand from the Chinese passenger vehicle market, the world’s largest, whose EV adoption rate that is far ahead of that of the United States and Europe. Close to 50% of new car sales in China are battery-powered electric vehicles, compared to just 9% in the United States. The Chinese government played a crucial role in shaping this industry through a mix of supply-side subsidies for battery production and demand-side incentives for EV buyers. Early buyer incentives stimulated purchasing even when products were not up to today’s level of performance, and those sales gave manufacturers a customer for their output and the cash flow to continue improving. Combined with a state-supported push to dominate the battery supply chain—from lithium mining to refining to manufacturing—these policies also helped create an ecosystem that has given Chinese manufacturers a nearly unassailable lead.

Intense domestic competition also has played an important role in giving the Chinese battery industry a cost advantage. More than 50 Chinese battery manufacturers are in a race to scale faster and cheaper than their rivals, resulting in overinvestment in capacity. By 2025, China’s battery production capacity is projected to reach 4,800 GWh, four times the expected global demand. This overcapacity may be reckless, but over the near term the extreme competition is driving costs lower. The more manufacturers produce, the more they refine their processes and squeeze efficiencies out of every step. As each manufacturer tries to outperform the next, the entire industry moves down the learning curve. Costs don’t just fall; they plummet.

Can Tariffs Help? The trade war that the Trump administration is waging could have important strategic implications for a number of industries that depend on volume learning. In theory, placing tariffs on imports—for example, on semiconductors or infant industries, such as rare earth metal processing or enzymes and amino acids produced using bio-manufacturing—could give domestic firms the ability to scale and move down the learning curve.

But that only works if those domestic makers are not too far behind and domestic consumers will buy the products from them. We have already seen some slowdowns in U.S. fab construction because of weak domestic demand for their processes. And if domestically produced semiconductors get subject to retaliatory tariffs or face export restrictions that cut their total addressable market, that would significantly affect the speed companies can progress down the learning curve.

Changing the Game - For severe laggards in industries where the learning curve matters, competing directly on cost is already looking like a lost cause. The only real way forward for them is to change the game. Understanding this, some battery companies are betting on radical process innovations like fully automated factories that use AI-driven quality control to further cut costs. In semiconductors, Rapidus in Japan is attempting to use a single wafer flow with advanced metrology and machine learning to accelerate learning. The opportunity is to use data-driven insights to drive process improvements and not have to depend on volume-based learning.

Other firms are looking at entirely new battery chemistries. Toyota, for example, is investing heavily in solid-state batteries, which could reset the learning curve by introducing a different production method that renders today’s lithium-ion scale advantages less relevant. In chemical processing or drug production, moving to continuous flow manufacturing offers the opportunity for a similar reset, using a less-capital-intensive production process that could more readily leverage AI to optimize yields and reduce unwanted byproducts.

Figuring out how to compete in industries that depend on volume learning is tricky in an era of fragmenting global markets. For laggards, counting on protectionist policies is dangerous: If those barriers disappear, they could be finished. Changing the game through process innovations or application of technologies may be their only hope.

Excerpted with edits; more at: https://hbr.org/2025/04/will-tariffs-drive-domestic-innovation

8. TARIFFS HIT SUPPLY CHAINS THAT ARE OFTEN VERY INTERNATIONAL

“Trump Announces 25% tariffs on car imports to US,” Natalie Sherman and Michael Race, BBC, March 27, 2025

This chart on manufacturing auto pistons shows how international supply chains have become, and the complexity of imposing tariffs on them.

Excerpted with edits; more at: https://www.bbc.com/news/articles/cly341xr45vo

9. ANOTHER APPROACH: GERMANY CREATES HIGH-TECH MINISTRY

“Germany to create ‘super-high-tech ministry for research, technology and aerospace,” Gretchen Vogel, Science, April 11, 2025

Germany will get a new “super–high-tech ministry” responsible for research, technology, and aerospace, according to the coalition agreement published by the incoming government this week.

The announcement is one of several nods to science in a 144-page agreement, unveiled on 9 April following weeks of negotiations between the center-right Christian Democrats (CDU) and its sister party, the Christian Social Union in Bavaria (CSU)—who together won the most seats in February’s federal elections—and the center-left Social Democrats. The agreement is expected to be formally approved by the three parties by early May, paving the way for CDU leader Friedrich Merz to be elected chancellor.

Under the plans, the current Ministry of Research and Education will be split. A new ministry for research, technology, and aerospace will be formed, and the education portfolio will be taken over by the current ministry for family, seniors, women, and youth. It is the first time in 3 decades that German research and technology will be under the same ministry, with research separate from education.

The new agreement lists a number of scientific priorities for the new government, including support for artificial intelligence, quantum technologies, biotechnology, microchip development and production, and fusion energy. “Our goal is that the world’s first fusion reactor should be realized in Germany,” the text states. It also mentions personalized medicine, oceans research, and sustainability research as “strategic” areas. But the agreement does not include any budget estimates, and observers caution it is unclear where the money for new programs would come from. The agreement does affirm current commitments to increase the budgets of the country’s main research organizations by 3% per year through 2030.

Excerpted with edits; more at: https://www.science.org/content/article/germany-creates-super-high-tech-ministry-research-technology-and-aerospace

Since 2022, MIT has formed a vision for Manufacturing@MIT—a new, campus-wide manufacturing initiative directed by Professors Suzanne Berger and A. John Hart that convenes industry, government, and non-profit stakeholders with the MIT community to accelerate the transformation of manufacturing for innovation, growth, equity, and sustainability. Manufacturing@MIT is organized around four Grand Challenges:

1. Scaling advanced manufacturing technologies

2. Training the manufacturing workforce

3. Establishing resilient supply chains

4. Enabling environmental sustainability and circularity

MIT’s Bill Bonvillian and David Adler edit this Update. We encourage readers to send articles that you think will be of interest to us at mfg-at-mit@mit.edu.