Manufacturing Update - 11 March 2025

Insights from articles and reports of interest on manufacturing technology, management, policy, and economics in the US and abroad

Table of contents for article summaries below:

TARIFF EFFECTS ON THE US AUTO SECTOR: “How Donald Trump’s tariffs threaten an iconic US pick-up truck”

TAIWAN EQUIVOCATES ON U.S. ACCESS TO TSMC ADVANCED CHIPS: “Taiwan vows most advanced tech will not go to the US under $100 billion Trump Deal”

FORMER CEO SAYS INTEL IS RECOVERING SO DON’T SELL IT OFF: “Craig Barrett: Intel is back - stop talking about breaking it up”

OSTP DIRECTOR DEFENDS CUTS TO SCIENCE AGENCIES: “OSTP Director Nominee Talks Federal Layoffs and R&D Strategy”

FEDERAL R&D IS BEING CUT – HOW MUCH IS THAT R&D AND WHAT HAS BEEN THE RETURN? “Frequently Asked Questions about US government funding for R&D”

TESLA AND SPACE X WERE BUILT ON GOVERNMENT SUBSIDIES: “Elon Musk’s business empire is built on $38 billion in government funding,”

APPLE TOUTS US INVESTMENT: “Apple plans $500 billion in US investment, 20,000 research jobs in four years”

HOW CHINA INDUSTRIALIZED SO RAPIDLY: “The Rise of Industrial Policy in China, 1978-2012”Subscribe for free by entering your email address below; you may unsubscribe at any time

1. TARIFF EFFECTS ON THE US AUTO SECTOR

“How Donald Trump’s tariffs threaten an iconic US pick-up truck,” Kana Inagaki, Paul Caruana Gallzia, Bob Haslett, Chris Cook and Claire Bushey, Financial Times, March 3, 2025

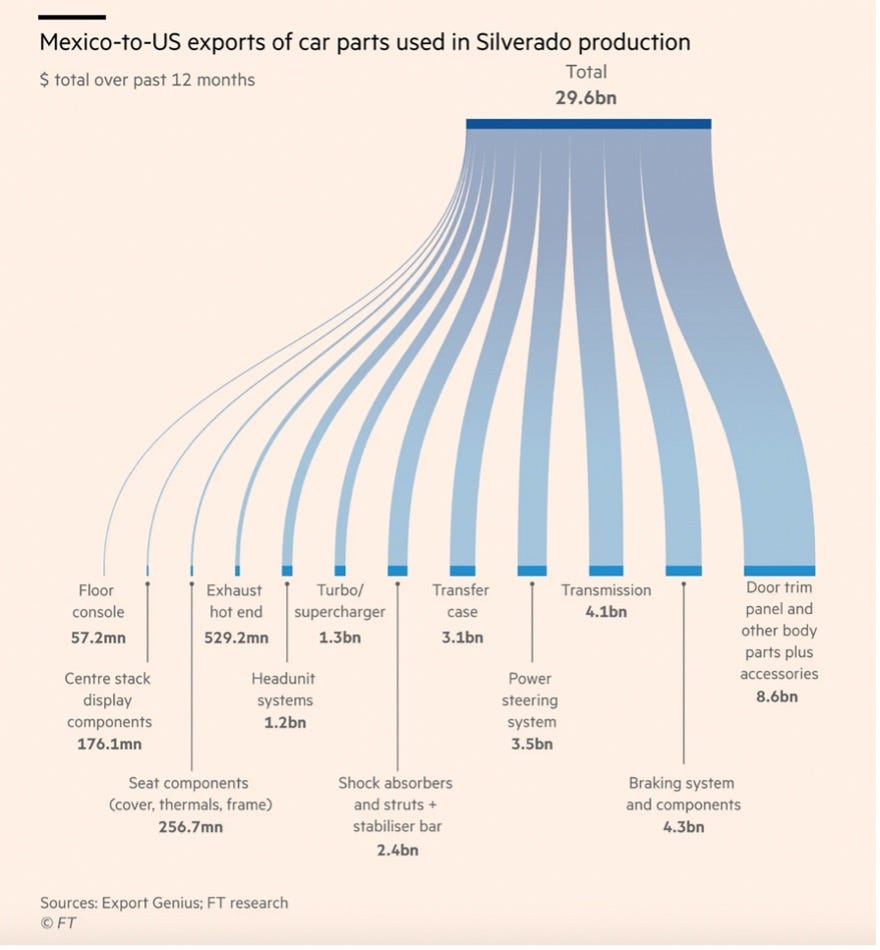

The Chevrolet Silverado has been one of America’s most popular pick-up trucks since it was launched almost three decades ago. But the iconic vehicle could now become one of the biggest victims of Donald Trump’s trade war. The high-margin General Motors model, which costs roughly $40,000-$70,000, relies on one of the most complex, international and interconnected automotive supply chains, making it particularly vulnerable to the US president’s plan to impose 25 per cent tariffs on Canada and Mexico. Of the 673,000 Silverados produced last year, 31 per cent were built at GM’s factory in the Mexican city of Silao and 20 per cent at its plant in Oshawa, Canada. But even for the roughly half manufactured at three US plants in Michigan and Indiana, it is likely that the power steering and door trim panels were built in Mexico; the rear lighting in Canada; the airbag module in Germany; and the center stack display in Japan.

Key components in Silverados are heavily dependent on parts imported from Mexico. The country’s exports of parts for the vehicle were worth almost $30bn last year, with braking systems alone accounting for $4.3bn. Trump threatened 25% tariffs on Mexico and Canada in early February and they took effect on March 4, although on March 5 he granted a one-month extension to automakers. The big fear within the industry is that Trump will impose blanket tariffs without mechanisms that are usually in place to mitigate their impact, such as duty drawback programs through which the levies can eventually be refunded if imported goods are subsequently re-exported.

A shift in manufacturing from Mexico to the US would take time and be expensive, while the higher price of labor would raise the costs of production. Ford chief executive Jim Farley has warned that “billions of dollars in industry profits” could be wiped out if there were protracted tariffs on imports from Mexico and Canada. John Elkann, chair of Chrysler owner Stellantis, last week called on Trump to keep goods from Mexico and Canada tariff-free.

Excerpted with edits; more at (paywall): https://www.ft.com/content/fb55f297-7e29-4215-a67f-4217e1a026d6

2. TAIWAN EQUIVOCATES ON US ACCESS TO TSMC ADVANCED CHIPS

“Taiwan vows most advanced tech will not go to the US under $100 billion Trump Deal,” Helen Davidson, The Guardian, March 4, 2025

Taiwan’s government has promised its most advanced semiconductor technology will not be moved to the US under a new $100bn deal signed between the chip maker TSMC and Donald Trump, amid accusations that it is allowing the island’s national security to be undermined. The government said the deal must still go through government assessments, which would take into account the interests of the country as well as investors.

On March 3, TSMC said it would increase its existing US investment by $100bn, building five new “cutting edge” facilities on US soil. This surprise announcement on Monday by Trump and the chief executive of Taiwan Semiconductor Manufacturing Co (TSMC), CC Wei, has prompted controversy and confusion in Taiwan, where the industry is crucial to its economy and national security. Trump said the deal meant TSMC would avoid the industry-wide 25% tariffs amid efforts to bring more manufacturing to the US and assert US trade dominance over rivals and allies. Wei said the deal meant TSMC was “producing the most advanced chip on US soil”.

That statement has been called into question by pledges from government officials that the tightly protected tech would stay onshore. The presidential office spokesperson, Karen Kuo, said the government would ensure TSMC “will keep its most advanced manufacturing processes in Taiwan”. But the specifics of any restrictions are unclear. In November, Taiwanese officials and media said TSMC would begin production of its most advanced 2-nanometer chip in its US facilities from about 2028. Asked if this was still the case, officials referred to comments by the economics minister, saying “next year, 2nm and 1.6nm [chips] will not be produced in the US.

Government statements also suggested TSMC had not yet applied for government approvals required for foreign investments of that size when the deal was announced. The Taiwan minister of economic affairs, Kuo Jyh-Huei, said that assessment would “take into account the interests of investors and the country.” Kuo, however, emphasized that the office had “full knowledge” of TSMC-related investments in advance. TSMC produces almost all the world’s most advanced semiconductors, and the industry is often referred to as Taiwan’s “silicon shield,” incentivizing the US and allies to support Taiwan against Chinese invasion in order to keep the tech out of Beijing’s control.

“Taking away Taiwan’s technology sector will reduce the power of Taiwan’s ‘silicon shield’,” said James Yifan Chen, assistant professor in the department of diplomacy and international relations at Tamkang University in Taiwan. “Taiwan without semiconductor and tech industries will be like Ukraine without nuclear weapons.”

Excerpted with edits; more at: https://www.theguardian.com/business/2025/mar/04/taiwan-trump-semiconductor-deal-tsmc

3. FORMER CEO SAYS INTEL IS RECOVERING SO DON’T SELL IT OFF

“Intel is back - stop talking about breaking it up,” Craig Barrett, Fortune, February 28, 2025

Four former Intel board members have written two opinion pieces for Fortune arguing that the only solution to Intel’s problems is to break the company into two pieces: a design company and a wafer fabrication (foundry) company. I do agree with their position that Intel should not sell its foundry business to TSMC but strongly disagree with their argument that Intel should be broken up.

Pat Gelsinger, who ran Intel the last three-plus years (he was abruptly fired two months ago) did a great job resuscitating the technology development team, and today the company’s leading technology [its 18A chip] is on par with TSMC’s 2nm technology. Additionally, Intel has a lead in the newest imaging technology (high NA EUV lithography, where they are currently processing 10,000s wafers) and in backside power delivery to complex chips. Both these accomplishments are key for future generations of silicon technology.

Intel is back—from a technology point of view. They are still struggling to attract independent chip designers, but they have the technology and manufacturing know-how to compete with the likes of TSMC. So, if Intel is back from a technology standpoint, what is the advantage of splitting up a company with 100,000-plus employees spread over several continents?

The former board members think that because Intel also makes and sells chips, no other chip designers will want to trust Intel to make their products. This thought process ignores the fact that the best technology wins in the semiconductor industry. All the independent designers currently use TSMC because TSMC has the best technology, so they don’t have any process technology advantage over each other. They are all using the same manufacturing technology to compete with each other and to compete with Intel chips. If Intel has equivalent or better technology than TSMC, then the game changes.

Intel failed in its previous efforts in the foundry (chip-making) business for the simple reason it did not have a competitive technology. The best technology wins, as you are at a disadvantage if you use an older version. Of course, Intel has to provide good customer service, fair pricing, guaranteed capacity, and a clear separation of chip designers from their foundry customers, but there is no disputing that the best technology wins. Intel used to lead in technology and chip design. They still struggle in chip design with the move to AI applications, but they are certainly back in manufacturing technology.

So, let’s stop talking about breaking up Intel as the only solution. Instead, let’s talk about Intel eating into TSMC’s current high-end foundry business, on the basis of Intel’s technology resurgence. Sure, the government can help by pushing U.S. firms to use a U.S. foundry. The government can also make an investment in Intel like they have done with other struggling institutions critical to the US economy and national security. But please stop talking about breaking up a company and dealing with all the complications and distractions therein. The company has gone through several CEOs and boards that did the wrong things.

Excerpted with edits; more at: https://fortune.com/2025/02/28/intel-future-craig-barrett-semiconductors-tsmc/

4. OSTP DIRECTOR DEFENDS CUTS TO SCIENCE AGENCIES

“OSTP Director Nominee Talks Federal Layoffs and R&D Strategy,” Clare Zhang, FYI-AIP, February 26, 2025

Michael Kratsios, the nominee to lead the White House Office of Science and Technology Policy, defended the recent layoffs at science agencies at his confirmation hearing February 25. He also said it is important for the U.S. to maintain leadership in emerging technologies and expressed support for federal funding of basic R&D but declined to weigh in on what the appropriate spending level should be, saying he would defer to President Donald Trump on topline budget numbers.

Democrats on the Senate Commerce, Science, and Transportation Committee pressed Kratsios to explain how firing federal scientists supports U.S. research. The Trump administration has laid off thousands of science agency employees in the last two weeks, including about 10% of the National Science Foundation’s workforce. Meanwhile, the National Institute of Standards and Technology is bracing for layoffs after some probationary employees received verbal notices about upcoming terminations last week, according to Axios and Bloomberg.

Sen. Lisa Blunt Rochester (D-DE) asked Kratsios if he is concerned about mass firings of scientists and engineers and if the U.S. risks losing ground to economic competitors like China as a result. Kratsios replied, “I think it’s very important when you enter into a new administration to have the opportunity to assess the team that you have on the field and determine what is the best way to be able to drive the priorities of the American people and the president. I think it’s very natural and common sense and logical to do that evaluation. And what I have observed from the outside is that these considerations of employment are ones that are not specifically targeted to science and technology, but are brought across all the agencies. So, I think it’s an important and necessary step to take when you start a new administration,” he continued.

Sen. Gary Peters (D-MI) argued that the layoffs were not done through careful evaluation but rather applied indiscriminately to probationary employees, including those who were recently promoted. Ranking Member Maria Cantwell (D-WA) asked Kratsios to reconcile his supportive comments toward federal science programs with the prospect of the administration slashing the budget of NSF. “I want to make sure I get the characterization. I don’t want you to say this and then I’ll find out, ‘Oh yeah, go ahead, take a meat cleaver to NSF.’”

Regarding reports that the Trump administration may propose to cut NSF’s budget by up to 66%, Kratsios said he would defer to the president and the White House Office of Management and Budget to decide topline budget numbers.

Excerpted with edits; more at: https://us17.campaign-archive.com/

5. FEDERAL R&D IS BEING CUT – HOW MUCH IS THAT R&D AND WHAT HAS BEEN THE RETURN?

“Frequently Asked Questions about US government funding for R&D,” Matt Clancy, New Things, February 2025

What does the federal government spend on R&D? The US government spent ~$160bn on R&D in 2022, about 2.6% of government spending. As a share of GDP for federal spending, federal support for R&D has declined for decades. We spend more on R&D in absolute terms than other big R&D producing countries, but are middling as a share of GDP. The private sector currently spends about 4x as much (although it overwhelmingly does this for development not earlier stage research).

Federal support for R&D was extremely elevated during the space race - in 1964, we were spending more than $2 on R&D for every $1 of private sector R&D and for every $20 of federal spending - but this fell rapidly. By 1990, the Cold War was over and the federal government was spending about $0.75 on R&D for every $1 of private sector R&D, about $0.95 out of every $20 of government spending, and about $1.03 out of every $100 of GDP. By 2022, this has declined even further, to $0.24 for every $1 in private sector spending, $0.52 out of every $20 in federal spending, and $0.61 out of every $100 in GDP.

We can also compare the US to other countries for more context. The US government leads the world in the absolute level of R&D it supports. The following figure gives government spending totals for the 8 countries or regions that account for the largest share of global R&D spending in 2021 (amounts adjusted for purchasing power parity).

However, as a share of GDP, the US is more middling among major R&D performers.

In 2021, the Federal spending on R&D was about 0.7% of GDP. In contrast, the South Korean government spent slightly more than 1.1% of GDP on R&D, which are levels the US has not been at since the late 1980s. The German government also spent a significantly larger share on R&D, at over 0.9% of GDP.

What is an estimate of the average return on investment of R&D? Averaged across government, the private sector, and other non-profits, the ROI is probably about $5.50 for every dollar of R&D if you focus only on GDP. If you put a dollar value on other benefits of R&D, I think $11 for every dollar is reasonable.

While it is very challenging to estimate the benefits from a specific R&D program (although many have tried), it is actually relatively straightforward to estimate the average ROI of research in general. The fundamental argument is a pretty simple one. If we believe that economic growth is derived from technological progress and technological progress is derived from spending on R&D and investment costs associated with building new technologies, then we can compute the average return on investment of R&D by dividing the value of growth by the cost of R&D and investment. You have to do some standard accounting adjustments to account for the fact that costs and benefits occur over different points in time, but Summers and Jones (2021) walk through how to do this calculation. If you assume a constant share of GDP devoted to R&D and investment generates constant exponential growth, which has been very roughly true for decades, then Jones and Summers (2021) shows the average benefits-to-costs ratio is given by this formula: Benefits-cost-ratio = g / (s * r) (Where g is per capita economic growth, s is the share of GDP spent on generating technological progress, and r is the interest rate.)

We will focus on the USA. In that case, g has averaged 1.8% since the 1950s and a pretty standard value for the interest rate r in economics is 5%. To estimate s, let’s add together the share of GDP devoted to R&D, which has averaged 2.5%, and the share of GDP devoted to embodying new ideas in technology. Since the embodiment of growth-enhancing ideas into technologies is overwhelmingly performed by the private sector, Jones and Summers suggest that net private sector investment is a reasonable proxy for this value. That has averaged 4.0% of GDP since the 1950s. Adding together R&D and private net investment, we get 6.5% as the share of GDP devoted to realizing technological progress. Taken together, we have 1.8% / (6.5% * 5%) = $5.50.

However, this formula only captures benefits that are reflected in GDP per capita. Nordhaus (2005) argues health gains range from 59%-126% of the value of income gains over the 20th century. I think we should err on the upper end of this range, because health is not the only benefit of technology not captured by GDP. Accordingly, it’s reasonable to assume the total benefits of technological progress are double the purely monetary value and average out to about $11 per $1 spent.

Excerpted with edits; more at: Ehttps://www.newthingsunderthesun.com/pub/d4ggviu4/release/1

6. TESLA AND SPACE X WERE BUILT ON GOVERNMENT SUBSIDIES

“Elon Musk’s business empire is built on $38 billion in government funding,” Desmond Butler, et al, Washington Post, February 26, 2025

Elon Musk and his cost-cutting U.S. DOGE service team have been on a mission to trim government largesse. Yet Musk is one of the greatest beneficiaries of the taxpayers’ coffers. Over the years, Musk and his businesses have received at least $38 billion in government contracts, loans, subsidies and tax credits, often at critical moments, a Washington Post analysis has found, helping seed the growth that has made him the world’s richest person.

The payments stretch back more than 20 years. Shortly after becoming CEO of a cash-strapped Tesla in 2008, Musk fought hard to secure a low-interest loan from the Energy Department, holding daily briefings with company executives about the paperwork and spending hours with a government loan officer. (The $460m loan saved the firm from bankruptcy in 2009.)

Nearly two-thirds of the $38 billion in funds have been promised to Musk’s businesses in the past five years. In 2024 alone, federal and local governments committed at least $6.3 billion to Musk’s companies, the highest total to date. The total amount is probably larger: This analysis includes only publicly available contracts, omitting classified defense and intelligence work for the federal government. SpaceX has been developing spy satellites for the National Reconnaissance Office, the Pentagon’s spy satellite division. The Wall Street Journal reported that contract was worth $1.8 billion, citing company documents. The Post found nearly a dozen other local grants, reimbursements and tax credits where the specific amount of money is not public. An additional 52 ongoing contracts with seven government agencies — including NASA, the Defense Department and the General Services Administration — are on track to potentially pay Musk’s companies an additional $11.8 billion over the next few years, according to The Post’s analysis.

Government contracts to SpaceX from NASA and the Defense Department make up the majority of funds. Tesla has earned $11.4 billion in regulatory credits from federal and state programs aimed at boosting the electric-car industry, and experts say its sales have been bolstered by a federal $7,500 electric-vehicle tax credit for consumers. Musk has called for an end to that consumer credit, arguing his competitors need the incentive more than Tesla.

Excerpted with edits; more at: https://www.washingtonpost.com/technology/interactive/2025/elon-musk-business-government-contracts-funding/

7. APPLE TOUTS US INVESTMENT

“Apple plans $500 billion in US investment, 20,000 research jobs, in four years,” Stephen Nellis, Reuters, February 24, 2025

After CEO Tim Cook met with President Trump the previous week, Apple said on February 24 it would spend $500 billion in U.S. investments in the next four years that will include a large factory in Texas for artificial intelligence servers and add about 20,000 research and development jobs across the country in that time.

That $500 billion in expected spending includes everything from purchases from U.S. suppliers to U.S. filming of television shows and movies for its Apple TV+ service. The company declined to say how much of the figure it was already planning to spend with its U.S. supply base, which includes firms such as Corning that makes glass for iPhones in Kentucky.

"This pledge represents a political gesture towards the Trump administration," said Gil Luria, analyst at D.A. Davidson. Apple made a similar announcement about its U.S. spending plans in 2018, during the first Trump administration, when it said its new and ongoing investments would contribute $350 billion to the U.S. economy over five years. Most of Apple's consumer products are assembled outside the U.S., though a number of Apple components are still made there[JD1] , including from Broadcom (a semiconductor design and chip firm), Skyworks Solutions (a wireless networking firm) and Qorvo (a connectivity firm). (None of its iPhone, iPod or Mac computer fabrication, now largely in China, would be made in the US under the plan). Apple said it last month started mass producing chips of its own design at an Arizona factory operated and owned by Taiwan Semiconductor Manufacturing Company.

Apple said on Monday it will work with Foxconn (its Taiwan-headquartered fabrication firm for its production in China) to build a 250,000-square-foot facility in Houston, where it will assemble servers that go into data centers to power Apple Intelligence, its suite of AI features that help draft emails and perform other tasks. Those servers are currently made outside of the U.S., Apple said. (Previously, highly-advertised plans by Foxconn to build a major plant in Wisconsin never materialized.) Apple said it plans to increase its Advanced Manufacturing Fund from $5 billion to $10 billion, with part of the expansion being a "multibillion-dollar commitment from Apple to produce advanced silicon” at TSMC's Arizona factory.

Apple also says it will also open a manufacturing academy in Michigan where its engineers, along with local university staff, will offer free courses for small and mid-sized manufacturing firms in areas such as project management and manufacturing process optimization. (It was not clear how many students this would reach and Apple has no operational facilities in Michigan.)

Excerpted with edits; more at: https://www.reuters.com/technology/artificial-intelligence/apple-plans-texas-factory-ai-servers-20000-research-jobs-2025-02-24/

8. HOW CHINA INDUSTRIALIZED SO RAPIDLY

“The Rise of Industrial Policy in China, 1978-2012” Sebastian Heilman and Lea Shih, Harvard-Yenching Institute Working Paper, 2013

What were the forces that facilitated the surge of national industrial policy programs in China after 2004? The paper traces the formative role of transnational exchanges with Japan for Chinese policy conceptions of industrial policy. Rival political and administrative actors filtered these conceptions so they could serve as either transitional or defensive policy recipes for pursuing their bureaucratic interests. During the 1990s, a core group of industrial policy advocates, through a series of large-scale research projects and program drafting efforts, became a driving force at the center of a broader policy coalition. While this coalition was overlooked or underrated in Western research, its statist agenda for China technology and production development came to dominate the peak bodies of policy making under the Hu Jintao-Wen Jiabao (2002-2013) administration.

Beyond the search for power and status, China's industrial policy coalition is held together by shared beliefs in active governmental guidance of the economy. These beliefs tend to stand in contrast to many neoclassical and also Keynesian policy prescriptions. Interviews with Chinese advocates of industrial policy generated statements and propositions that appear closer to arguments brought up in classic works on Japanese industrial policy: the basic direction of economic and social development cannot, and must not, be determined by market forces; governments must impose broader, longer-term perspectives and priorities than markets; concerted state action is indispensable in a world of politically distorted markets; the financial industry must remain under strict government supervision; industrial policy can serve as a mechanism of anticipatory or ad-hoc economic adjustment; and industrial policy aims to go beyond just riding the waves of markets by actively creating the waves on which to ride.

Fundamentally, industrial policy is embraced by Chinese policymakers as a justification of enduring political controls over the economic, sectoral and technological pathways of development. It is legitimized by its core advocates as a golden mean between economically suffocating full state control (as in the former administrative allocation system) and politically threatening market volatilities or dysfunctions (as seen in financial services-driven economies).

The formation and rise of China's industrial policy advocacy coalition was for a long time ignored by Western research and media, due to a fixation with their plan-to-market narrative that focuses on the purportedly universal, or convergent, macro-processes of marketization, economic liberalization and privatization. The plan-to-market narrative resulted in biases and analytical blinders when confronted with policy ideas and actors that did not fit into the preconceived framework. However, it was precisely the overlooked or underrated actors with originally Japan-inspired "statist" agendas that came to dominate the peak bodies of economic policy-making under the Hu-Wen administration.

Excerpted with edits; more at: https://www.harvard-yenching.org/wp-content/uploads/legacy_files/featurefiles/Sebastian%20Heilmann%20and%20Lea%20Shih_The%20Rise%20of%20Industrial%20Policy%20in%20China%201978-2012.pdf

Since 2022, MIT has formed a vision for Manufacturing@MIT—a new, campus-wide manufacturing initiative directed by Professors Suzanne Berger, A. John Hart, and Christopher Love that convenes industry, government, and non-profit stakeholders with the MIT community to accelerate the transformation of manufacturing for innovation, growth, equity, and sustainability. Some of the issues the initiative is considering include:

1. Scaling advanced manufacturing technologies

2. Training the manufacturing workforce

3. Establishing resilient supply chains

4. Enabling environmental sustainability and circularity

MIT’s Bill Bonvillian and David Adler edit this Update. We encourage readers to send articles that you think will be of interest to us at mfg-at-mit@mit.edu.